When you open a small business, the last thing you want to do is the paperwork and bookkeeping, that is unless you’re actually starting up as a bookkeeper or an accountant.

However, it’s necessary that you use bookkeeping to stay on top of your new business. You can’t possibly be disorganized or put off paperwork and expect to keep your business running smoothly.

Maintaining a healthy cash flow comes from being on top of your bookkeeping. This will also allow you to spot certain trends in your finances sooner rather than later. The ability to spot potential issues with your finances before they become a huge issue is invaluable as your business grows.

Here are some basics that every business owner, whether a sole trader or limited company, should know when it comes to bookkeeping.

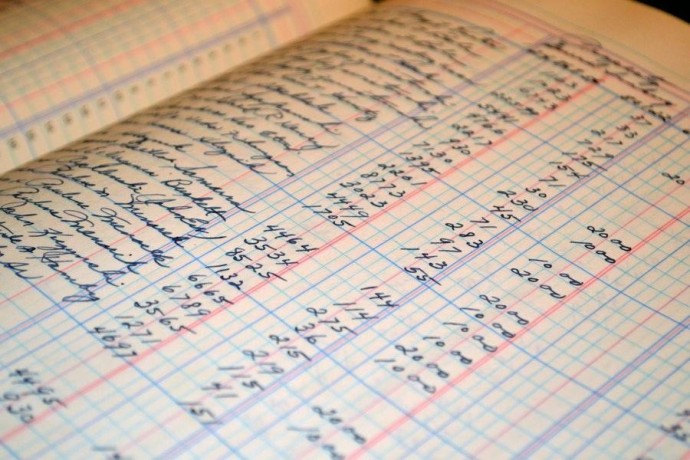

Properly Keeping Financial Records

Your accountant will fill you in on exactly what your business needs, but these are some general records that you should be keeping:

Cash Book

These are the payments that are coming and going through your bank account. You need to keep these up to date. After a while, you will be able to better understand your finances. It will become a forecasting tool rather than a historical record.

Invoice File for Sales

Taking advantage of accounting packaged can help you store invoices. If you manually keep track of them using Word, keep a record of it on file. You should always store your invoices in chronological order and keep the ones that haven’t been paid at the front of the file to ensure credit control.

Invoice File for Purchases

Make it a habit to note when you paid and how you paid your invoices such as BACS, cash, checks, etc. Chronologically file them and this will make your life a lot easier and will also help keep your accountants’ bill down.

Always Get An Invoice Receipt for Every Purchase

It’s always been known that the longer you are in business, the more likely you are of becoming the center of a tax investigation or VAT. Generally, it’s nothing to worry about as long as you have your accountant on your side with all your paperwork. Ensure that you are keeping track of every transaction that you make. If you order something online, print the invoice. It is much easier to collect the paperwork as you go rather than trying to find it all in the future.

Keep Business and Personal Expenses Separate

If your business is a limited company, then the business money does not belong to you, even if it’s 100% yours. You cannot spend the company’s money for your own purchases unless it’s legitimately for the business.

If you are self-employed, you can take money from your business, but it should be from a separate account. Keep all your accounts clean by keeping your personal and business finances separate.

Keep Tabs on Bank Statements

Each month, you should take some time to check your bank statements. This can help eliminate the risk for fraud or a mistake by your bank. This will also help you get a better understanding of where you are at for money. Businesses that are successful have better credit control and spend their money in a smart way. This should be a good habit from the beginning.

Do Your Bookkeeping Regularly

When you first start out, some businesses owners are tempted to do their bookkeeping at night. However, if you’re tired, the simplest tasks are going to take the longest and you are more likely to make silly mistakes.

If you need to perform a task outside of business hours when you could be earning some money, consider waking up earlier in the morning or doing it on a Saturday morning or afternoon. Make it a regular habit day-to-day.

Hire A Bookkeeper or Accountant for Financial Assistance

You should never skimp out on professional help with your finances. A capable Ottawa accountant will save you more money than what you are paying them. If they can’t be proactive, them and find somebody through recommendations or some hefty searching. It’s easy to find a new accountant through professional codes.

If you can’t seem to keep up with up-to-date paperwork, then maybe it’s time to hire a bookkeeper to get those books in order regularly. Not only will they reduce the bill for your accountant, but they can potentially earn you more money in the long run.

If you are currently charging £50 and can give the bookkeeper £25 and hour, you should continue to work while they get your accounts straightened out for you. Remember that an expert may be able to do it in half the time that you would be able to.

You should be able to find a good bookkeeper in Ottawa by asking other business owners for some recommendations. You can also check out the Institute of Certified Bookkeepers. This has thousands of highly qualified bookkeepers and they can put you in touch with one of the members nearest to you.